How does it work?

- Bank clients, SME and public, can deposit or change their money at multi-service devices at various convenient locations

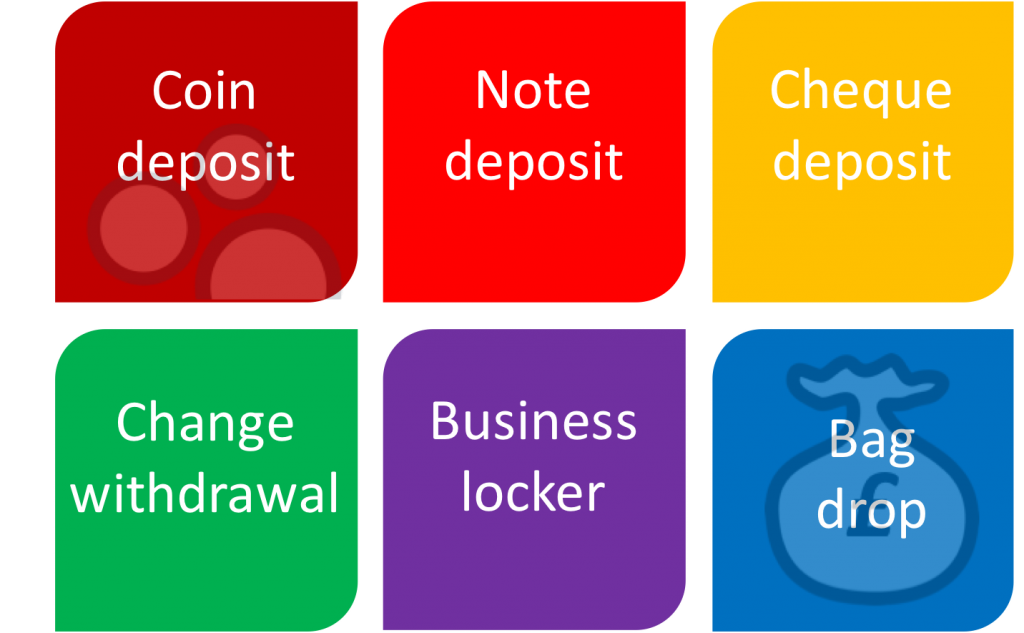

- Functionality can include any variation of…

- Bag drop including mixtures of notes, coins and cheques

- Note deposit

- Coin deposit

- Note dispensing

- Rolled coin dispensing

- Locker support to allow documents, valuables and other services to the clients

- Efficient and convenient systems for small and medium businesses

- Automates services allowing banks to reducing overhead dependency

- Cash recycling and 24hr change machines for local businesses

- Banks maintain a presence in less populated areas to provide more services for their customers

Benefits

- Banks retain their loyal customers with less dependency on traditional services

- Lower running cost than a branch

- Banks retain a high street presence

- No staff needed, therefore increased profit

- Efficiency through automation allowing bank to focus on sales channel

- Potential for stronger sales channel to be developed

- Alignment of branch services with core bank channel strategy

Advantages

- Automation can now be deployed easily and effectively without the need for high build costs

- No need for large IT integration projects as services can be setup around existing bank functionality

- Reporting, management and services can be exactly aligned with the bank requirements

- Branding will be that of the bank, providing consistency and customer loyalty